Canadian Institutes of Health Research Annual Report 2024–25

Content

- Chair's Message

- Providing Stewardship and Accountability

- Financial Statement Discussion and Analysis

- Financial Statements

Message from the Chair of CIHR Governing Council

Dr. Marie-Josée Hébert

Chair, CIHR Governing Council

On behalf of Governing Council, I am pleased to present the 2024-25 Annual Report of the Canadian Institutes of Health Research (CIHR), the Government of Canada's health research investment agency.

This year's report coincides with CIHR's 25th anniversary — a milestone that calls on all Canadians to reflect on the profound influence of health research on our daily lives. To highlight the immense impact that CIHR has had over its 25 years and some of the health research milestones we've hit, I invite you to visit our CIHR at 25 webpage.

The achievements of the past year build on the successes of the CIHR Strategic Plan 2021-2031, while reaffirming CIHR's commitment to its core mandate: to excel in the creation of new knowledge and its translation into better health and prosperity for Canadians and a stronger Canadian health care system.

This year, the agency was pleased to welcome its new President, Dr. Paul Hébert, a world-renowned clinician-scientist. With the President's guidance and the oversight of Governing Council, CIHR has continued to forge and strengthen partnerships to drive discovery, support evidence-based solutions and advance health system transformation across Canada, while reinforcing our country's leadership in scientific excellence.

These collaborative efforts have contributed to strengthening the health innovation ecosystem — from excellence to impact — for the benefit of all Canadians in the most effective way possible.

Collaboration to Strengthen Canada's Research Enterprise

Through the Canada Research Coordinating Committee (CRCC), which brings together leaders from the Government of Canada's science-based departments and agencies, including Health Canada, Innovation, Science and Economic Development Canada (ISED), the National Research Council Canada (NRC), the Canada Foundation for Innovation (CFI), the Office of the Chief Science Advisor, and the three federal research funding agencies - CIHR, NSERC, and SSHRC - CIHR has played a vital leadership role in modernizing and better coordinating the federal research support system.

Over the past year, CIHR and its tri-agency partners, NSERC and SSHRC, have:

- Implemented significant Budget 2024 investments in core research programs. As a result, CIHR was able to increase the total amount of funding in the Fall 2024 Project Grant competition from $325M to $411M, representing 98 additional projects;

- Co-developed and launched the new harmonized Canada Research Training Awards Suite, which increased the value and number of tri-agency scholarships and postdoctoral fellowships. This Suite streamlined the support for the next generation of research talent - critical to Canada's knowledge economy;

- Advanced towards an improved and harmonized grants management system;

- Continued investments in tri-agency initiatives for high-impact, interdisciplinary research, such as Lab to Market grants, which foster entrepreneurship and commercialization capacity in academia to help transform research into real-life solutions; and

- Introduced new measures to safeguard Canadian research and intellectual property, protecting national and economic security.

Supporting Government of Canada Priorities

Health research is essential to improving the health and prosperity of Canadians. This year, CIHR – with scientific leadership from its 13 Institutes, played a central role in the Government of Canada's research response to health challenges facing Canadians. Many of these efforts were carried out in collaboration with federal partners, such as Health Canada, the Public Health Agency of Canada, ISED, NRC, Heritage Canada, and tri-agency partners.

An important achievement continues to be CIHR's investments to advance and transform youth mental health care systems through innovative and integrated service models. Integrated Youth Services (IYS) is an approach to connect individuals ages 12 to 25 to a wide variety of mental health and social services and came to be through research efforts to transform how mental health care was delivered to young people. Leveraging this model, CIHR and partners have launched funding opportunities focused on the expansion and linkage of IYS networks across Canada, including this year's investment of a federated data platform. The IYS Data Platform will enable access and sharing of timely, accurate, and comprehensive data sets with a focus on continued improvement of youth mental health and substance use health care across Canada.

CIHR's research initiatives also contributed to meaningful progress on several Government of Canada strategies and actions plans, including:

- Canada's National Dementia Strategy: Aligned with CIHR's continued leadership of the research and innovation pillar of the Strategy, CIHR funded the development of a knowledge mobilization hub, which will serve as a centralized resource for evidence-based tools and practices, supporting researchers, healthcare providers, caregivers and those living with dementia. This hub aims to improve care by leveraging and integrating knowledge generated through research. For example, this could include insights gathered in a study led by Dr. Hoben at York University, funded by past investments through this strategy, that found that key health systems interventions to improve the effects of day programs on individuals with dementia and their caregivers include ensuring access to a social worker to support caregivers, and sufficient staffing (including access to nurses) to improve care for clients.

- Framework for Diabetes in Canada: In partnership with JDRF, CIHR funded new knowledge mobilization grants aimed at integrating the latest diabetes evidence into health services, programs, and policies. These grants foster collaboration among researchers, policymakers, healthcare providers, and people with lived experience to improve the prevention and care of diabetes across the country. For example, Dr. Valeria Rac at University Health Network received funding to support her work to integrate existing diabetes resources and recommend improvements to care organization, funding, and capacity to support eventual diabetic retinopathy screening implementation.

- National Strategy for Drugs for Rare Diseases: In partnership with the NRC, CIHR funded research that bridges the gap between fundamental research on rare diseases and clinical trials to help accelerate the development of new rare disease drugs in Canada. This recent funding opportunity builds on previous CIHR investments in rare disease research to support the implementation of this strategy. This includes support for the establishment of RareKids-CAN, a network dedicated to supporting pediatric rare disease clinical trials in Canada. In June 2025, this network, led by Dr. Thierry Lacaze-Masmonteil and others at the Maternal Infant Child and Youth Research Network, in partnership with the Riddell Centre for Cancer Immunotherapy, supported the Health Canada regulatory submission to enable experimental therapy using virus-specific T cells to successfully treat a newborn with a life-threatening infection. This exemplifies how certain capabilities in cell and gene therapy can be extended across health disciplines to deliver innovative treatments for patients with rare and complex conditions.

- Canada's Biomanufacturing and Life Sciences Strategy: CIHR supported the advancement of the clinical trials ecosystem in Canada by funding 14 new clinical trials through the second round of its Clinical Trials Fund (CTF). These investments aim to accelerate the development of made-in-Canada medical innovations, vaccines, and therapies.

In addition to the targeted investments under the Biomanufacturing and Life Sciences Strategy, CIHR's broader leadership in clinical trials was further demonstrated through its support for a Pan-Canadian Clinical Trials Research Network. This Network established research infrastructure that advances innovative, community-centred clinical trials aimed at prevention, treatment, and management of HIV/AIDS and sexually transmitted and blood-borne infections and related comorbidities.

Beyond clinical trials, CIHR also engaged on emerging scientific frontiers with transformative potential—such as genomics. This year, CIHR was pleased to collaborate with Genome Canada and other federal partners - including the other federal granting agencies – on the launch of the new Canadian Genomics Strategy. This Strategy includes a commitment to developing top-tier talent in Canada's genomics sector to address labour shortages in the bioeconomy.

While innovations in clinical trials and genomics research hold great promise for creating a more effective and efficient health care system, their success depends on the strength of Canada's health workforce. Recognizing this, CIHR invested in health workforce research, delivered in partnership with SSHRC, the Canadian Partnership Against Cancer, and Michael Smith Health Research BC. This investment will inform the implementation, evaluation, and spread of evidence-informed workforce solutions that address system-level challenges and help to build a more resilient health workforce in the future.

Complementing these efforts to strengthen the health system, CIHR also advanced efforts to support equitable access to quality care for all Canadians, regardless of the official language they speak. This was done through CIHR's investment in research which seeks to understand and improve the experiences of official language minority communities when accessing the health care system.

In the continued development of Canada's research capacity for health emergencies, CIHR, in collaboration with other federal and provincial partners, also initiated a rapid research response to help Canada prevent, prepare for, recover from, and respond to outbreaks of avian influenza A(H5N1). For example, Drs. Mike McKay, Kenneth Ng, and Dan Mennil, a multidisciplinary team based at the University of Windsor, received funding to use a One Health Approach to monitor avian influenza genomic sequences in southwestern Ontario lakes and rivers. These upstream methods, which aim to more rapidly identify changes in the flu that could lead to a pandemic, are already yielding results, validating this novel method that utilizes environmental samples. Ideally, these efforts will help catch any spread of viruses entering Canada during spring bird migrations, before they spread throughout wildlife or human populations, allowing for more time to mitigate and prepare as needed.

Further, CIHR continued to prioritize supporting research on the knowledge generation opportunities identified in the Chief Public Health Officer's Annual Report, which focused on mobilizing public health systems in Canada to apply a health promotion approach to public health emergency preparedness and response.

Finally, extending its commitment to equitable and inclusive health research, CIHR also prioritized addressing long-standing gaps in women's health. For instance, CIHR, in partnership with Heart and Stroke, invested in two new national research networks for women's heart and brain health. Additionally, through its National Women's Health Research Initiative, CIHR invested in applied research to address gaps and progress interventions towards improving access to care and health outcomes for women, girls, and gender diverse people across Canada.

Advancing Domestic and International Partnerships for Impact

Strategic domestic and international partnerships are essential to CIHR's ability to generate knowledge, translate evidence into practice, and build research capacity across Canada and beyond. These collaborations enable CIHR to respond to diverse health needs, strengthen health systems, and support innovation.

One example of this collaborative approach is the partnership between CIHR, the Government of Nunavut, Nunavut Tunngavik Incorporated, the Nunavut Research Institute, and the Qaujigiartiit Health Research Centre to fund the creation of the Nunavut Strategy for Patient-Oriented Research (SPOR) Support for People and Patient-Oriented Research and Trials (SUPPORT) Unit. This SPOR SUPPORT Unit will align local health research with community needs, ensuring that evidence-based solutions improve care and wellness in Inuit communities in Nunavut.

Through its Best Brains Exchange (BBE) program, CIHR also continued to support the integration of evidence into federal, provincial, and territorial health systems decision-making. For example, in January 2025, CIHR hosted a BBE in partnership with Health Canada, the Canadian Primary Care Research Network, and the Governments of Newfoundland and Labrador and Alberta on the development of the draft Pan-Canadian evaluation framework for team-based primary care. This event was particularly impactful, as it brought together representatives from every province and territory, facilitating cross-jurisdictional learning and collaboration.

This year, CIHR advanced its commitment to capacity building through the Health System Impact Program, in partnership with Michael Smith Health Research BC and the Fonds de recherche du Québec. Through the 2024 cycle of this program, 25 PhD trainees and 20 postdoctoral researchers will be embedded in 34 health organizations across the country to lead projects aimed at generating evidence to improve Canada's health systems.

Finally, to further support the next generation of researchers, CIHR, in collaboration with Genome Canada and Mitacs, also supported the development of interdisciplinary, and inter-jurisdictional research training platforms that will attract a diverse cadre of trainees and early career researchers and equip them with the skills and knowledge required for a range of careers within and outside of academia.

Accelerating the Self-Determination of Indigenous Peoples in Health Research

Since 2016, CIHR's Action Plan: Building a healthier future for First Nations, Inuit and Métis Peoples has articulated CIHR's commitment to advancing reconciliation and Indigenous health priorities.

Building on this foundation, CIHR made significant strides this year. Notably, Dr. Chelsea Gabel, Associate Professor in the Indigenous Studies Department and the Department of Health, Aging and Society at McMaster University, was appointed as the Scientific Director of the Institute of Indigenous Peoples' Health.

Importantly, the Network Environments for Indigenous Health Research (NEIHR) — part of Canada's largest ever investment in Indigenous health research – was renewed. The NEIHRs bring together researchers, Indigenous leaders and community members in every region of the country to support community-based health research grounded in Indigenous ways of knowing. These networks will continue their important work to address significant health disparities and train the next generation of First Nations, Inuit and Métis health researchers.

Finally, following the Budget 2024 commitment to support and increase Indigenous participation in research, the federal granting agencies announced new upcoming funding opportunities that were co-developed with Inuit, First Nations and Métis Peoples focused on Indigenous self-determination, the decolonization of research, and more equitable access and support for Indigenous organizations and researchers.

I trust the information and data contained within this report will provide a clear understanding of CIHR's activities and progress over the past year. I invite you to read the financial details that follow to gain further insights into the investments that facilitate support for advancing scientific knowledge and enhancing its integration to improve health and healthcare delivery.

Sincerely,

Dr. Marie-Josée Hébert

Chair, CIHR Governing Council

Providing Stewardship and Accountability

CIHR Governing Council

CIHR reports to Parliament through the Minister of Health. Its Governing Council comprises a group of up to 16 members appointed by the Governor in Council, as well as the President of CIHR and the Deputy Minister of Health who are ex-officio non-voting members. Together they provide oversight and strategic direction for the organization and evaluate its overall performance.

Marie-Josée Hébert

Chair

Université de Montréal

Shanthi Johnson

Vice-Chair

University of Windsor

Paul Allison

Faculty of Dentistry

McGill University

Robert S. Bell

Former Deputy Minister, Ontario Ministry of Health and Long-Term Care

Mélanie Caron

National Institute of Excellence in Health and Social Services (INESSS)

Eric Costen

Acting Deputy Minister, Health Canada

(Ex-officio, non-voting member)

Deborah DeLancey

Former Deputy Minister, Health and Social Services NWT

Annie Descôteaux

Université de Montréal

Christine Fahim

University of Toronto

Paul Hébert

President, CIHR

(Ex-officio, non-voting member)

Michal Juhas

Digital health expert and independent consultant: health policy, economics, and outcomes research

Brianne Kent

Simon Fraser University

Cathy Kline

University of British Columbia

Josette-Renée Landry

Genome Québec

Bernard Le Foll

CAMH/ Waypoint (University of Toronto)

Stephen Lucas

Deputy Minister of Health Canada

(Ex-officio, non-voting member)

Siddika Mithani

Member, Research Board

Children's Hospital of Eastern Ontario & Hôpital Montfort

Greg Orencsak

Deputy Minister of Health Canada

(Ex-officio, non-voting member)

Amélie Quesnel-Vallée

McGill University

Michael Salter

The Hospital for Sick Children

Caroline Tait

University of Calgary

Financial Statement Discussion and Analysis

Introduction

The following Financial Statement Discussion and Analysis (FSD&A) should be read in conjunction with the Canadian Institutes of Health Research (CIHR) financial statements and accompanying notes for the year ended March 31, 2025.

The responsibility for the integrity and objectivity of the FSD&A rests with the management of CIHR. The purpose of the FSD&A is to highlight information and provide explanations to enhance the user's understanding of CIHR's financial position and results of operations, while demonstrating CIHR's accountability for its use of available resources. Additional information on CIHR's performance is available in the CIHR Departmental Results Report, and information on its plans and priorities is available in the CIHR Department Plan.

Overview

The Canadian Institutes of Health Research was established in June 2000 under the Canadian Institutes of Health Research Act. It is listed in Schedule II to the Financial Administration Act as a departmental corporation. CIHR's objective is to excel, according to international standards of scientific excellence, in the creation of new knowledge, and its translation into improved health, more effective health services and products, and a strengthened Canadian health care system.

CIHR's budget is allocated through authorities approved by Parliament. CIHR has separate voted authorities for operating expenses and for grants/awards. Authorities provided to CIHR by Parliament do not parallel financial reporting according to Canadian public sector accounting standards, since authorities are primarily based on cash accounting principles. Consequently, items recognized in the Statement of Financial Position, the Statement of Operations and Departmental Net Financial Position, the Statement of Change in Departmental Net Debt, and the Statement of Cash Flows are not necessarily the same as those provided through authorities from Parliament. Note 3 of the Financial Statements provides users with a reconciliation between the two bases of reporting.

Highlights

CIHR's financial results in 2024-25 are generally consistent with those of the preceding fiscal year.

1. Statement of Financial Position

| As at March 31 | 2025 | 2024 | % change |

|---|---|---|---|

| Total liabilities | $16.8 | $16.8 | 0.0% |

| Total financial and non-financial assets | $15.9 | $15.1 | 5.3% |

Total liabilities remained stable year over year. Accounts payable and accrued liabilities increased by $0.5 million, primarily due to accrued salaries and wages.

Total financial and non-financial assets increased by $0.8 million, primarily due to an $0.9 million increase in tangible capital assets. This increase was mainly driven by the capitalization of $1.3 million in expenses related to leasehold improvements for CIHR's new worksite location. The $0.6 million decrease in other receivables reflects the recovery of overpayments made in fiscal year 2023–24.

2. Statement of Operations and Departmental Net Financial Position

| For the year ended March 31 | 2025 | 2024 | % change |

|---|---|---|---|

| Total expenses | $1,428.5 | $1,356.8 | 5.3% |

| Net cost of operations before government funding and transfers | $1,424.7 | $1,355.0 | 5.1% |

The increase to both total expenses (5.3%) and in net cost of operations before government funding and transfers (5.1%) is primarily attributable to the fact that total parliamentary authorities available to CIHR in 2024-25 were higher than those of 2023-24. CIHR's total available parliamentary authorities increased by $49.0 million in 2024-25 due to an increase in authorities for Vote 5 – Grants ($53.4 million), offset by decreased authorities for Vote 1 – Operating Expenditures and statutory authorities ($4.4 million).

3. Variance Analysis

3.1 Total annual authorities available

CIHR's 2024-25 year-end Parliamentary authorities of $1,425.6 million represents an increase of $49 million (3.5%) compared to CIHR's 2023-24 year-end authorities of $1,376.6 million.

| 2024-25 Main Estimates (in millions of dollars) | $1,369.6 |

|---|---|

| Funding to increase support to core Research | 23.0 |

| Funding to support graduate students and postdoctoral researchers | 22.5 |

| Funding for the Gairdner Foundation | 10.0 |

| 2023-24 Operating budget carry-forward | 0.6 |

| Compensation adjustments from the Treasury Board Secretariat | 1.9 |

| Net transfers from other government departments | (2.0) |

| Total increase in Parliamentary authorities during the year | 56.0 |

| 2024-25 Year-end Parliamentary authorities | $1,425.6 |

3.2 Variances between current year actual results and prior year actual results

| For the year ended March 31 | 2025 | 2024 | % change |

|---|---|---|---|

| Grants and awards | $1,333.6 | $1,255.2 | 6.2% |

| Operating expenses | $94.9 | $101.6 | (6.6)% |

Grants and awards expenses increased by $78.4 million (or 6.2%) in 2024-25 due to increased parliamentary authorities provided to CIHR to support health research across Canada. Overall grants and awards expenses are consistent with the prior fiscal year.

Total operating expenses decreased by $6.7 million (6.6%) compared to the previous year. This decrease is primarily due to a one-time increase in salary and employee benefits expenses in the prior year. In 2023-24, CIHR employees received retroactive pay increases effective April 1, 2022. Secondly, CIHR's total headcount at year end has decreased from 616 in 2023-24 to 572 in 2024-25.

Other operating expenses decreased in 2024-25 as compared to the prior fiscal year. Professional and special services expenses decreased by approximately $1.7 million as part of the Refocusing Government Spending initiative. Budget 2023 announced that spending on professional service would be refocused starting 2023-24. Accommodation expenses also decreased in 2024-25 (by $1.8 million, or 46.8%) due to a significant decrease in CIHR's footprint at 160 Elgin. Furniture, equipment and software increased $0.3 million (165.0%) due to the purchase of communication equipment.

4. Trend Analysis

4.1 Grants and Awards Expenses

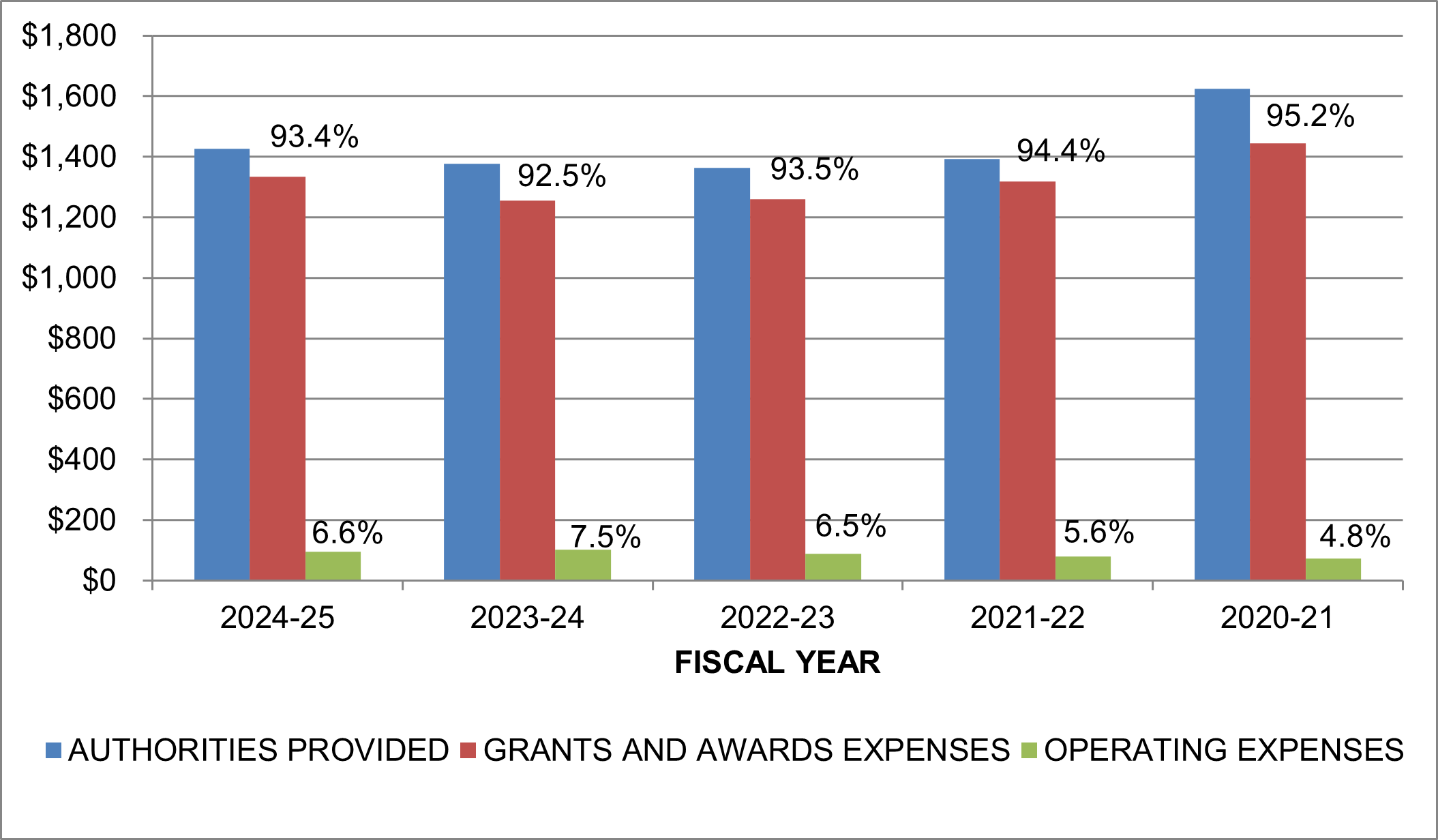

(in millions of dollars)

Grants and Awards Expenses - Long Description

| 2024–25 | 2023–24 | 2022–23 | 2021–22 | 2020–21 | |

|---|---|---|---|---|---|

| Authorities provided | $1,425.7 | $1,376.6 | $1,362.3 | $1,392.9 | $1,624.2 |

| Grants and awards expenses | $1,333.6 | $1,255.2 | $1,259.1 | $1,318.2 | $1,443.8 |

| Operating expenses | $94.9 | $101.6 | $87.5 | $78.5 | $73.5 |

| Percentage grants and awards | 93.4% | 92.5% | 93.5% | 94.4% | 95.2% |

| Percentage operating expenses | 6.6% | 7.5% | 6.5% | 5.6% | 4.8% |

- The proportion of grants and awards expenses in relation to changes in the Parliamentary authorities fluctuate minimally from year to year.

- The ratio of operating expenses to total expenses was 6.6% in 2024-25 compared to 7.5% in 2023-24.

- In 2024-25, grants and awards expenses made up 93.4% of total expenses, as compared to 92.5% in 2023-24.

4.2 Operating Expenses

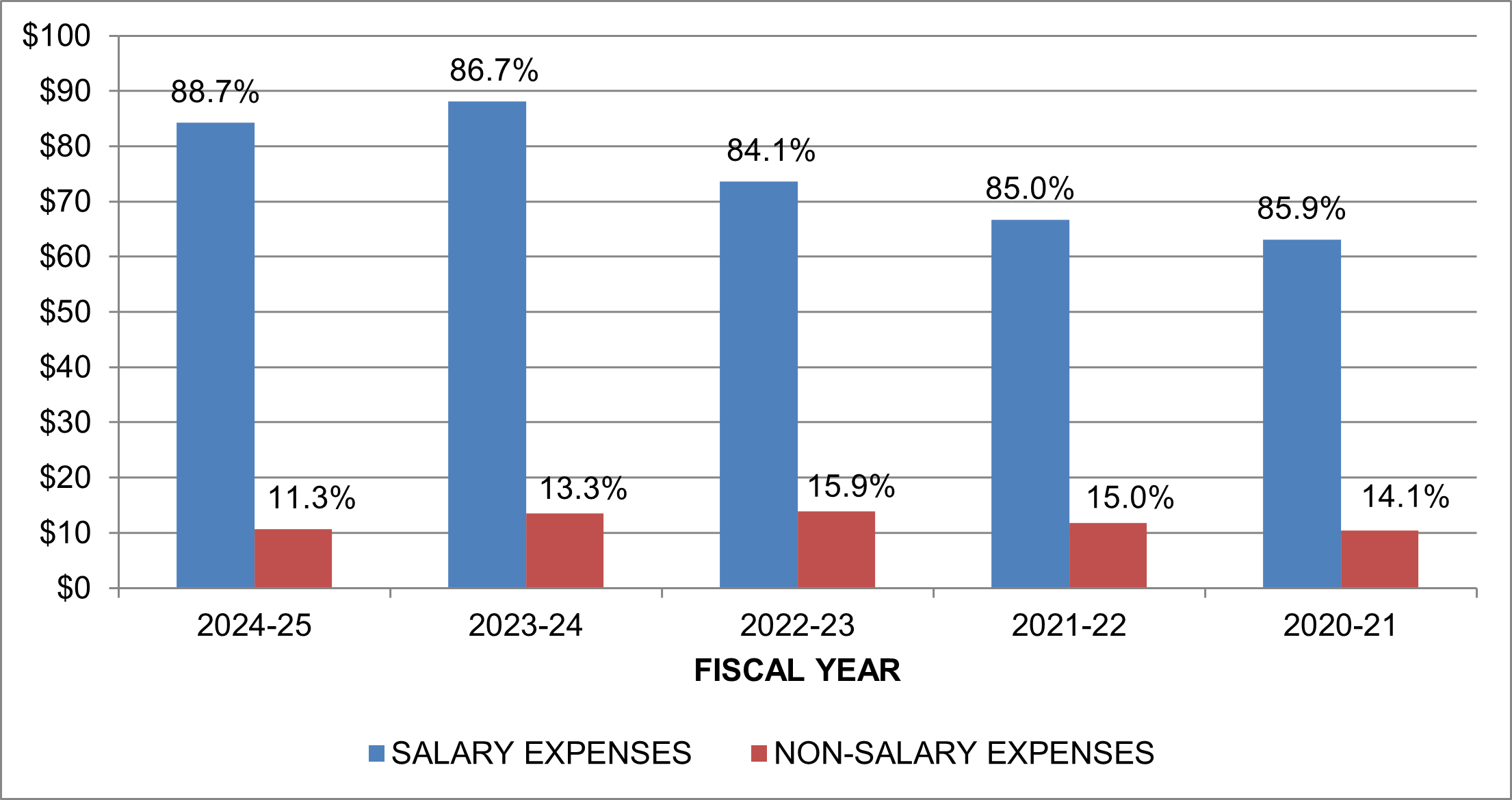

(in millions of dollars)

Operating Expenses - Long Description

| 2024-25 | 2023-24 | 2022-23 | 2021–22 | 2020–21 | |

|---|---|---|---|---|---|

| Salary expenses | $84.2 | $88.1 | $73.6 | $66.7 | $63.1 |

| Non-salary expenses | $10.7 | $13.5 | $13.9 | $11.8 | $10.4 |

| Total | $94.9 | $101.6 | $87.5 | $78.5 | $73.5 |

| Percentage salary expenses | 88.7% | 86.7% | 84.1% | 85.0% | 85.9% |

| Percentage non-salary expenses | 11.3% | 13.3% | 15.9% | 15.0% | 14.1% |

- In 2024-25, salaries and employee benefits made up 88.7% of total operating expenses compared to 86.7% in the prior year.

- The ratio of operating expenses to total expenses was 6.6% in 2024-25 compared to 7.5% in 2023-24.

- Salary and employee benefit expenses decreased by $3.9 million in 2024-25 compared to the prior fiscal year. This decrease is primarily due to a one-time increase in salary and employee benefits expenses in the prior year. In 2023-24, CIHR employees received retroactive pay increases effective April 1, 2022. Secondly, CIHR's total headcount at year end has decreased from 616 in 2023-24 to 572 in 2024-25.

Financial Outlook

While Budget 2025 is expected to the tabled next Fall, CIHR continues to be driven by Government of Canada priorities and is committed to maintaining its support to the research community.

CIHR is aligning its financial planning with the federal government's Refocusing Government Spending (RGS) initiative, which aims to reallocate expenditures toward priority areas and improve fiscal sustainability. In Budget 2023, the federal government committed to reducing spending by $14.1 billion over five years, starting in 2023–24. As part of this commitment, CIHR has incurred annual reductions of $1.44 million starting in 2024–25, primarily through decreased spending on internal services.

While future specific impacts continue to be assessed, CIHR is actively reviewing its spending plans in coordination with the Treasury Board Secretariat. These efforts aim to support government-wide objectives while minimizing disruption to CIHR's core research funding programs.

Despite these operating spending reductions, CIHR's capacity to deliver on its mandate is reinforced by recent investments announced in Budget 2024. These investments include $541 million over five years ($229 million ongoing) to increase support to core research grants and $204 million over five years ($62 million ongoing) to increase the value and number of scholarships and fellowships and launch the new harmonized talent program called the Canada Research Training Awards Suite (CRTAS).

CIHR is committed to implementing these changes thoughtfully to ensure continued support for Canada's health research community. Further details and specific impacts on CIHR's authorities are expected in upcoming government communications.

Financial Statements

Canadian Institutes of Health Research

Statement of Management Responsibility Including Internal Control over Financial Reporting

Responsibility for the integrity and objectivity of the accompanying financial statements for the year ended March 31, 2025, and all information contained in these financial statements rests with the management of the Canadian Institutes of Health Research (CIHR). These financial statements have been prepared by management using the Government of Canada's accounting policies, which are based on Canadian public sector accounting standards.

Management is responsible for the integrity and objectivity of the information in these financial statements. Some of the information in the financial statements is based on management's best estimates and judgment, and gives due consideration to materiality. To fulfill its accounting and reporting responsibilities, management maintains a set of accounts that provides a centralized record of CIHR's financial transactions. Financial information submitted in the preparation of the Public Accounts of Canada, and included in CIHR's Departmental Results Report, is consistent with these financial statements.

Management is also responsible for maintaining an effective system of internal control over financial reporting (ICFR) designed to provide reasonable assurance that financial information is reliable, that assets are safeguarded and that transactions are properly authorized and recorded in accordance with the Financial Administration Act and other applicable legislation, regulations, authorities, and policies.

Management seeks to ensure the objectivity and integrity of data in its financial statements through careful selection, training and development of qualified staff; through organizational arrangements that provide appropriate divisions of responsibility; through communication programs aimed at ensuring that regulations, policies, standards and managerial authorities are understood throughout CIHR; and through conducting an annual risk-based assessment of the effectiveness of the system of ICFR.

The system of ICFR is designed to mitigate risks to a reasonable level based on an ongoing process to identify key risks, to assess effectiveness of associated key controls, and to make any necessary adjustments. A risk-based assessment of the system of ICFR for the year ended March 31, 2025 was completed in accordance with the Treasury Board Policy on Financial Management and the results and action plans are summarized in the annex.Footnote 1

The effectiveness and adequacy of CIHR's system of internal control is reviewed by the work of internal audit staff, who conduct periodic audits of different areas of CIHR's operations, and by CIHR's Audit Committee, which oversees management's responsibilities for maintaining adequate control systems and the quality of financial reporting, and which recommends the financial statements to the President of CIHR and its Governing Council.

The financial statements of CIHR have not been audited.

Approved by:

Paul C. Hébert, MD, MHSc, FRCPC, FCAHS

President

Jimmy Fecteau, MBA, CPA

Chief Financial Officer

Ottawa, Canada

July 23, 2025

Canadian Institutes of Health Research

Statement of Financial Position (unaudited)

As at March 31

(in thousands of dollars)

| 2025 | 2024 | |

|---|---|---|

| Liabilities | ||

| Accounts payable and accrued liabilities (note 4) | $8,422 | $7,962 |

| Vacation pay and compensatory leave | 4,818 | 5,181 |

| Deferred revenue (note 5) | 3,030 | 3,138 |

| Employee future benefits (note 6) | 502 | 544 |

| Total liabilities | 16,772 | 16,825 |

| Financial assets | ||

| Due from Consolidated Revenue Fund | 11,453 | 11,100 |

| Accounts receivable (note 7) | 627 | 1,032 |

| Total financial assets | 12,080 | 12,132 |

| Departmental net debt | 4,692 | 4,693 |

| Non-financial assets | ||

| Prepaid expenses | 468 | 530 |

| Tangible capital assets (note 8) | 3,374 | 2,458 |

| Total non-financial assets | 3,842 | 2,988 |

| Departmental net financial position | $(850) | $(1,705) |

|

Contractual obligations (note 9) The accompanying notes form an integral part of these financial statements. |

||

Approved by:

Paul C. Hébert, MD, MHSc, FRCPC, FCAHS

President

Marie-Josée Hébert, MD, FRCPC, MACSS

Chair, Governing Council

Ottawa, Canada

July 23, 2025

Canadian Institutes of Health Research

Statement of Operations and Departmental Net Financial Position (unaudited)

For the year ended March 31

(in thousands of dollars)

| 2025 | 2025 | 2024 | |

|---|---|---|---|

| Planned Results (note 2) |

|||

| Expenses | |||

| Funding health research and training | $1,385,515 | $1,377,937 | $1,303,944 |

| Internal Services | 45,786 | 50,557 | 52,874 |

| Total expenses | 1,431,301 | 1,428,494 | 1,356,818 |

| Revenues | |||

| Funding health research and training | 3,695 | 3,832 | 1,832 |

| Total revenues | 3,695 | 3,832 | 1,832 |

| Net cost of operations before government funding and transfers | $1,427,606 | $1,424,662 | $1,354,986 |

| Government funding and transfers | |||

| Net cash provided by Government of Canada | $1,416,883 | $1,341,705 | |

| Change in due from the Consolidated Revenue Fund | 353 | 2,337 | |

| Services provided without charge by other government departments (note 11) | 8,281 | 10,396 | |

| Net cost of operations after government funding and transfers | (855) | 548 | |

| Departmental net financial position – beginning of year | (1,705) | (1,157) | |

| Departmental net financial position – end of year | $(850) | $(1,705) | |

|

Segmented information (note 12) The accompanying notes form an integral part of these financial statements. |

|||

Canadian Institutes of Health Research

Statement of Change in Departmental Net Debt (unaudited)

For the year ended March 31

(in thousands of dollars)

| 2025 | 2024 | |

|---|---|---|

| Net cost of operations after government funding and transfers | $(855) | $548 |

| Change due to tangible capital assets | ||

| Acquisition of tangible capital assets | 1,494 | 466 |

| Amortization of tangible capital assets | (578) | (577) |

| Proceeds from disposal of tangible capital assets | (19) | - |

| Gain on disposal of tangible capital assets | 19 | - |

| Total change due to tangible capital assets | 916 | (111) |

| Change due to prepaid expenses | (62) | (160) |

| Net increase in departmental net debt | (1) | 277 |

| Departmental net debt – beginning of year | 4,693 | 4,416 |

| Departmental net debt – end of year | $4,692 | $4,693 |

|

The accompanying notes form an integral part of these financial statements. |

||

Canadian Institutes of Health Research

Statement of Cash Flows (unaudited)

For the Year ended March 31

(in thousands of dollars)

| 2025 | 2024 | |

|---|---|---|

| Operating activities | ||

| Net cost of operations before government funding and transfers | $1,424,662 | $1,354,986 |

| Non-cash items: | ||

| Services provided without charge by other government departments (note 11) | (8,281) | (10,396) |

| Amortization of tangible capital assets | (578) | (577) |

| Gain on disposal of tangible capital assets | 19 | - |

| Variations in Statement of Financial Position: | ||

| Increase/(Decrease) in accounts receivable | (405) | 373 |

| (Decrease) in prepaid expenses | (62) | (160) |

| (Increase) in accounts payable and accrued liabilities | (460) | (974) |

| Decrease/(Increase) in vacation pay and compensatory leave | 363 | (759) |

| Decrease/(Increase) in deferred revenue | 108 | (1,363) |

| Decrease in employee future benefits | 42 | 109 |

| Cash used in operating activities | 1,415,408 | 1,341,239 |

| Capital investing activities | ||

| Acquisitions of tangible capital assets | 1,494 | 466 |

| Proceeds from disposal of tangible capital assets | (19) | - |

| Cash used in capital investing activities | 1,475 | 466 |

| Net cash provided by Government of Canada | $1,416,883 | $1,341,705 |

|

The accompanying notes form an integral part of these financial statements. |

||

Canadian Institutes of Health Research

Notes to the Financial Statements (unaudited)

As at March 31

(in thousands of dollars)

1. Authority and objectives

The Canadian Institutes of Health Research (CIHR) was established in June 2000 under the Canadian Institutes of Health Research Act, replacing the former Medical Research Council of Canada. It is listed in Schedule II to the Financial Administration Act as a departmental corporation.

CIHR's objective is to excel, according to international standards of scientific excellence, in the creation of new knowledge, and its translation into improved health, more effective health services and products, and a strengthened Canadian health care system. CIHR's core responsibility is funding health research and training. CIHR is Canada's health research investment agency. By funding research excellence, CIHR supports the creation of new knowledge and its translation into improved health for Canadians, more effective health services and products and a strengthened Canadian health care system. This is done by providing grants that fund health research and/or provide career and training support to the current and next generation of researchers.

CIHR's core responsibility is achieved based on three programs:

The first program is Investigator-Initiated Research, which provides funding to conduct research in any area related to health aimed at the discovery and application of knowledge. Funding is provided to researchers and academic organizations to conduct research, translate knowledge, and build capacity through research training and salaries. Applicants identify and propose the nature and scope of the research and compete for support by demonstrating excellence and the potential impact the research will have on health systems and/or health outcomes.

The second program is Training and Career Support, which provides award funding directly to promising current and next generation researchers to support training or career development. Applicants at different career stages compete through a rigorous process and those with the highest potential for promising research careers are funded.

The third program is Research in Priority Areas, which provides funding for targeted grants and awards aimed at addressing priority areas. Priorities are identified by CIHR in consultation with other government departments and agencies, partners and stakeholders. The program mobilizes researchers, patients, health providers, and decision makers to conduct research, enable knowledge translation and build capacity in the priority areas. It often requires collaboration within and across sectors.

CIHR is governed by a Governing Council of up to 18 members appointed by the Governor in Council. There are 16 members, including the Chair, that are voting members and two that are non-voting, ex officio members: the Deputy Minister of Health Canada and the President of CIHR. The Governing Council sets overall strategic direction, goals and policies and oversees programming, ethics, budget and planning.

CIHR has 13 institutes that focus on identifying the research needs and priorities for specific health areas, or for specific populations, then developing strategic initiatives to address those needs. Each institute is led by a Scientific Director who is guided by an Institute Advisory Board, which strives to include representation of the public, researcher communities, research funders, health professionals, health policy specialists and other users of research results.

CIHR's grants, awards and operating expenditures are funded by budgetary authorities. Employee benefits are funded by statutory authorities.

2. Summary of significant accounting policies

These financial statements are prepared using CIHR's accounting policies stated below, which are based on Canadian public sector accounting standards. The presentation and results using the stated accounting policies do not result in any significant differences from Canadian public sector accounting standards.

Significant accounting policies are as follows:

-

Parliamentary authorities

CIHR is financed by the Government of Canada through parliamentary authorities. Financial reporting of authorities provided to CIHR does not parallel financial reporting according to generally accepted accounting principles since authorities are primarily based on cash flow requirements. Consequently, items recognized in the Statement of Operations and Departmental Net Financial Position and in the Statement of Financial Position are not necessarily the same as those provided through authorities from Parliament.

Note 3 provides a reconciliation between the bases of reporting. The planned results amounts in the "Expenses" and "Revenues" sections of the Statement of Operations and Departmental Net Financial Position are the amounts reported in the Future-oriented Statement of Operations (unaudited) included in the 2024-25 Departmental Plan. Planned results are not presented in the "Government funding and transfers" section of the Statement of Operations and Departmental Net Financial Position and in the Statement of Change in Departmental Net Debt because these amounts were not included in the 2024-25 Departmental Plan.

-

Net cash provided by Government of Canada

CIHR operates within the Consolidated Revenue Fund (CRF), which is administered by the Receiver General for Canada. All cash received by CIHR is deposited to the CRF and all cash disbursements made by CIHR are paid from the CRF. The net cash provided by the Government of Canada is the difference between all cash receipts and all cash disbursements, including transactions between departments of the Government of Canada.

-

Amounts due from the CRF

Amounts due from or to the CRF are the result of timing differences at year-end between when a transaction affects authorities and when it is processed through the CRF. Amounts due from the CRF represent the net amount of cash that CIHR is entitled to draw from the CRF without further authorities to discharge its liabilities.

-

Revenues and deferred revenues

Funds received from external parties for specified purposes are recorded upon receipt as deferred revenue. Revenues are then recognized in the period in which the related expenses are incurred.

Deferred revenue consists of amounts received in advance of the delivery of goods and rendering of services that will be recognized as revenue in a subsequent fiscal year as it is earned.

-

Expenses

Grants and awards (transfer payments) are recorded as an expense in the year the transfer is authorized and all eligibility criteria have been met by the recipient.

Vacation pay and compensatory leave are accrued as the benefits are earned by employees under their respective terms of employment.

Services provided without charge by other government departments for accommodation and employer contributions to the health and dental insurance plans are recorded as operating expenses at their carrying value.

-

Employee future benefits

-

Pension benefits

Eligible employees participate in the Public Service Pension Plan (the Plan), a multiemployer defined benefit pension plan administered by the Government of Canada. CIHR's contributions to the Plan are charged to expenses in the year incurred and represent the total departmental obligation to the Plan. CIHR's responsibility with regard to the Plan is limited to its contributions. Actuarial surpluses or deficiencies are recognized in the financial statements of the Government of Canada, as the Plan's sponsor.

-

Severance benefits

The accumulation of severance benefits for voluntary departures ceased for CIHR executive and non-represented employees in 2011. The remaining obligation for employees who did not withdraw benefits is calculated on the retained accumulated weeks of severance at their current rate of pay as at March 31.

-

-

Accounts receivable

Accounts receivable are initially recorded at cost. When necessary, an allowance for valuation is recorded to reduce the carrying value of accounts receivable to amounts that approximate their net recoverable value.

-

Tangible capital assets

The costs of acquiring land, buildings, equipment and other capital property are capitalized as tangible capital assets and are amortized to expense over the estimated useful lives of the assets. All tangible capital assets and leasehold improvements having an initial cost of $10,000 or more are recorded at their acquisition cost.

Amortization of tangible capital assets is done on a straight-line basis over the estimated useful life of the capital asset as follows:

Asset class Amortization period Informatics hardware 3–5 years Informatics software 3–10 years Office equipment 10 years Vehicles 5 years Assets under construction are not amortized until they become available for use. The cost of a constructed asset includes direct construction or development costs (such as materials and/or labour) and overhead costs directly attributable to the construction or development activity.

-

Contingent liabilities

Contingent liabilities are potential liabilities that may become actual liabilities when one or more future events occur or fail to occur. If the future event is likely to occur or fail to occur, and a reasonable estimate of the loss can be made, a provision is accrued and an expense recorded to other expenses. If the likelihood is not determinable or an amount cannot be reasonably estimated, the contingency is disclosed in the notes to the financial statements.

-

Measurement uncertainty

The preparation of these financial statements requires management to make estimates and assumptions that affect the reported and disclosed amounts of assets, liabilities, revenues and expenses reported in the financial statements and accompanying notes at March 31. The estimates are based on facts and circumstances, historical experience and general economic conditions and reflect CIHR's best estimate of the related amount at the end of the reporting period. The most significant items where estimates are used are contingent liabilities, the liability for employee future benefits and the useful life of tangible capital assets.

Actual results could significantly differ from those estimated. Management's estimates are reviewed periodically and, as adjustments become necessary, they are recorded in the financial statements in the year they become known.

-

Related party transactions

Related parties include individuals who are members of key management personnel (KMP) or close family members of those individuals and entities controlled by, or under shared control of, a member of KMP or a close family member of that individual. KMP are individuals having the authority and responsibility for planning, directing and controlling the activities of CIHR. Related party transactions, other than inter-entity transactions, are recorded at the exchange value.

Inter-entity transactions are transactions between commonly controlled entities. CIHR is a component of the Government of Canada reporting entity and is therefore related to all federal departments, agencies and Crown corporations. Inter-entity transactions are recorded on a gross basis and are measured at the carrying amount, except for the following:

- Services provided on a recovery basis are recognized as revenues and expenses on a gross basis and measured at the exchange amount.

- Certain services received on a without charge basis are recorded for departmental financial statements purposes at the carrying amount.

3. Parliamentary authorities

CIHR receives most of its funding through annual parliamentary authorities. Items recognized in the Statement of Operations and Departmental Net Financial Position and the Statement of Financial Position in one year may be funded through parliamentary authorities in prior, current or future years. Accordingly, CIHR has different net results of operations for the year on a government funding basis than on an accrual accounting basis. The differences are reconciled in the following tables:

-

Reconciliation of net cost of operations to current year authorities used

2025 2024 Net cost of operations before government funding and transfers $1,424,662 $1,354,986 Adjustments for items affecting net cost of operations but not affecting authorities: Amortization of tangible capital assets (578) (577) Services provided without charge by other government departments (8,281) (10,396) Decrease/(Increase) in vacation pay and compensatory leave 363 (759) Decrease in employee future benefits 42 109 Refunds of previous years' grants and awards 6,503 4,988 Bad debt expense (28) - Gain on disposal of tangible capital assets 19 - Other adjustments 219 16 (1,741) (6,619) Adjustments for items not affecting net cost of operations but affecting authorities: Acquisition of tangible capital assets 1,494 466 Increase/(Decrease) in accounts receivable for salary overpayments 20 (216) (Decrease) in prepaid expenses (62) (160) 1,452 90 Current year authorities used $1,424,373 $1,348,457 -

Authorities provided and used

2025 2024 Authorities provided: Vote 1 - Operating expenditures $78,864 $82,970 Vote 5 - Grants 1,336,871 1,283,480 Statutory amounts 9,896 10,183 Less: Frozen authorities (8) (26,566) Authorities available for future years (601) (599) Lapsed: Operating - (450) Lapsed: Grants (649) (561) Current year authorities used $1,424,373 $1,348,457

4. Accounts payable and accrued liabilities

The following table presents details of CIHR's accounts payable and accrued liabilities:

| 2025 | 2024 | |

|---|---|---|

| Accounts payable - other government departments and agencies | $1,211 | $1,470 |

| Accounts payable - external parties | 62 | 3 |

| Total accounts payable | 1,273 | 1,473 |

| Accrued liabilities | 7,149 | 6,489 |

| Total accounts payable and accrued liabilities | $8,422 | $7,962 |

5. Deferred revenue

Deferred revenue represents the balance at year-end of unearned revenues stemming from amounts received from external parties that are restricted in order to fund the expenditures related to specific research projects and stemming from amounts received for fees prior to services being performed. Revenue is recognized in the period in which these expenditures are incurred or in which the service is performed. Details of the transactions related to this account are as follows:

| 2025 | 2024 | |

|---|---|---|

| Opening balance | $3,138 | $1,775 |

| Amounts received | 3,724 | 3,195 |

| Revenue recognized | (3,832) | (1,832) |

| Closing balance | $3,030 | $3,138 |

6. Employee future benefits

-

Pension benefits

CIHR's employees participate in the Plan, which is sponsored and administered by the Government of Canada. Pension benefits accrue up to a maximum period of 35 years at a rate of 2 percent per year of pensionable service, times the average of the best five consecutive years of earnings. The benefits are integrated with the Canada/Québec Pension Plans benefits and they are indexed to inflation.

Both the employees and CIHR contribute to the cost of the Plan. Due to the amendment of the Public Service Superannuation Act following the implementation of provisions related to Economic Action Plan 2012, employee contributors have been divided into two groups – Group 1 relates to existing plan members as of December 31, 2012 and Group 2 relates to members joining the Plan as of January 1, 2013. Each group has a distinct contribution rate.

The 2024-25 employer contributions amount to $6,347 ($6,029 in 2023-24). For Group 1 members, the expense represents approximately 1.02 times (1.02 times in 2023-24) the employee contributions and, for Group 2 members, approximately 1.00 times (1.00 times in 2023-24) the employee contributions.

CIHR's responsibility with regard to the Plan is limited to its contributions. Actuarial surpluses or deficiencies are recognized in the Consolidated Financial Statements of the Government of Canada, as the Plan's sponsor.

-

Severance benefits

Severance benefits provided to CIHR's employees were previously based on an employee's eligibility, years of service and salary at termination of employment. However, since 2011, the accumulation of severance benefits for voluntary departures progressively ceased for substantially all employees. Employees subject to these changes were given the option to be paid the full or partial value of benefits earned to date or collect the full or remaining value of benefits upon departure from the public service. By March 31, 2025, all settlements for immediate cash-out were completed. Severance benefits are unfunded and, consequently, the outstanding obligation will be paid from future authorities.

The changes in the obligations during the year were as follows:

2025 2024 Accrued benefit obligation - beginning of year $544 $653 Expense for the year 32 93 Benefits paid during the year (74) (202) Accrued benefit obligation - end of year $502 $544

7. Accounts receivable

The following table presents details of CIHR's accounts receivable balances:

| 2025 | 2024 | |

|---|---|---|

| Accounts receivable - other government departments and agencies | $487 | $259 |

| Accounts receivable - external parties | 151 | 784 |

| Allowance for doubtful accounts receivable from external parties | (11) | (11) |

| Total accounts receivable | $627 | $1,032 |

8. Tangible capital assets

| Cost | Accumulated amortization | Net book value | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Capital asset class | Opening balance | Acquisitions | AUC Transfer | Disposals and write-offs | Closing balance | Opening balance | Amortization | Disposals and write-offs | Closing balance | 2025 | 2024 |

| Informatics hardware | $1,698 | $- | $- | $(18) | $1,680 | $1,545 | $102 | $(18) | $1,629 | $51 | $153 |

| Informatics software | 21,112 | - | 1,962 | (239) | 22,835 | 20,606 | 473 | (239) | 20,840 | 1,995 | 506 |

| Office equipment | 11 | - | - | - | 11 | 3 | 2 | - | 5 | 6 | 8 |

| Vehicles | 30 | 49 | - | (30) | 49 | 30 | 1 | (30) | 1 | 48 | - |

| Assets under construction (AUC) | 1,791 | 1,445 | (1,962) | - | 1,274 | - | - | - | - | 1,274 | 1,791 |

| Total | $24,642 | $1,494 | $- | $(287) | $25,849 | $22,184 | $578 | $(287) | $22,475 | $3,374 | $2,458 |

9. Contractual obligations

The nature of CIHR's programs may result in large multi-year contracts and obligations whereby CIHR will be obligated to make future payments in order to carry out its grants and awards payment programs or when the services/goods are received. Significant contractual obligations that can be reasonably estimated are summarized as follows:

| Grants and awards | Operating expenditures | Total | |

|---|---|---|---|

| 2026 | $1,103,550 | $3,745 | $1,107,295 |

| 2027 | 869,353 | 468 | 869,821 |

| 2028 | 590,664 | 135 | 590,799 |

| 2029 | 343,744 | 85 | 343,829 |

| 2030 | 181,253 | - | 181,253 |

| 2031 and subsequent | 31,398 | - | 31,398 |

| Total | $3,119,962 | $4,433 | $3,124,395 |

10. Contingent liabilities

CIHR may be subject to claims and litigation in the normal course of business. Management has not identified any claims with a material impact on the financial statements and, consequently, no provision has been made.

11. Related party transactions

-

Common services provided without charge by other government departments

During the year, CIHR received services without charge from certain common service organizations related to accommodation and the employer's contribution to the health and dental insurance plans. These services provided without charge are recorded at the carrying value in CIHR's Statement of Operations and Departmental Net Financial Position as follows:

2025 2024 Employer's contribution to the health and dental insurance plans $6,200 $6,485 Accomodation 2,081 3,911 Total $8,281 $10,396 The Government has centralized some of its administrative activities for efficiency, cost-effectiveness purposes and economic delivery of programs to the public. As a result, the Government uses central agencies and common service organizations so that one department performs services for all other departments and agencies without charge. The costs of these services, such as the payroll and cheque issuance services provided by Public Services and Procurement Canada, are not included in CIHR's Statement of Operations and Departmental Net Financial Position.

-

Administration of programs on behalf of other government departments

Under a memorandum of understanding signed with the Natural Sciences and Engineering Research Council (NSERC) and the Social Sciences and Humanities Research Council (SSHRC), CIHR administers funds for the Vanier Canada Graduate Scholarship and Banting Postdoctoral Fellowship programs. During the year, CIHR incurred expenses of $23,445 ($22,343 in 2023-24) for grants and awards on behalf of NSERC and SSHRC. These expenses are reflected in the financial statements of NSERC and SSHRC and are not recorded in these financial statements.

12. Segmented information

Presentation by segment is based on CIHR's core responsibilities. The presentation by segment is based on the same accounting policies as described in the Summary of Significant Accounting Policies in note 2. The following table presents the expenses incurred and revenues generated for the main core responsibilities, by major object of expense and by major type of revenue. The segment results for the year are as follows:

| 2025 | 2024 | |||

|---|---|---|---|---|

| Funding health research and training | Internal Services | Total | Total | |

| Grants and awards | $1,333,552 | $- | $1,333,552 | $1,255,226 |

| Operating expenses | ||||

| Salaries and employee benefits | 42,224 | 41,960 | 84,184 | 88,118 |

| Rentals | 7 | 3,585 | 3,592 | 3,117 |

| Professional and special services | 681 | 1,946 | 2,627 | 4,306 |

| Accomodation | 1,047 | 1,034 | 2,081 | 3,911 |

| Communication | 222 | 447 | 669 | 613 |

| Amortization of tangible capital assets | - | 578 | 578 | 577 |

| Furniture, equipment and software | - | 506 | 506 | 191 |

| Other | - | 415 | 415 | 142 |

| Travel | 204 | 76 | 280 | 424 |

| Utilities, materials and supplies | - | 10 | 10 | 193 |

| Total operating expenses | 44,385 | 50,557 | 94,942 | 101,592 |

| Total expenses | 1,377,937 | 50,557 | 1,428,494 | 1,356,818 |

| Revenues | ||||

| Donations for health research | 3,832 | - | 3,832 | 1,832 |

| Total revenues | 3,832 | - | 3,832 | 1,832 |

| Net cost from continuing operations | $1,374,105 | $50,557 | $1,424,662 | $1,354,986 |

13. Comparative information

Comparative figures have been reclassified to conform to the current year's presentation.

- Date modified: